Managing your business finances doesn’t have to be overwhelming, even if you’re not great with numbers. Automated financial software can help you track revenue, expenses, and profit with ease. Here’s how:

- Profit = Revenue - Expenses: This simple formula shows if your business is making money.

- Automated Tools Save Time: Software like QuickBooks, Wave, or Expensify connects to your bank, categorizes expenses, and generates real-time profit reports.

- No Math Skills Needed: These tools handle calculations, tax tracking, and even receipt scanning automatically.

Switching from manual tracking to financial software can save you hundreds of hours annually and provide clear insights into your financial health. With just a few steps - choosing the right tool, linking your accounts, and reviewing reports - you can simplify financial management and focus on growing your business.

How I track my business income and expenses without pulling my hair out

Revenue, Expenses, and Profit: The Basics

To understand your business's profitability, you need to get familiar with three essential terms: revenue, expenses, and profit. Revenue, often referred to as the "top line", is the total income your business earns from selling products or services. Expenses cover the costs of running your business, such as rent, utilities, marketing, and supplies. Finally, profit, also known as the "bottom line", is what's left after deducting expenses from revenue.

Here’s the simple formula:

Profit = Revenue - Expenses.

For instance, if your business brought in $10,000 in sales last month but spent $7,000 on operating costs like rent, advertising, and supplies, your profit would be $3,000.

What Profitability Means

Profitability is all about earning more than you spend - it’s the cornerstone of sustaining and growing a business. However, high revenue doesn’t always mean you’re profitable. Imagine generating $50,000 in sales each month but spending $55,000 to operate. Even with impressive sales figures, you’d still be losing money.

FreshBooks explains it well:

"A profit and loss statement demonstrates your business's ability to generate profits. It shows the sales you're earning and how you're managing your expenses."

Understanding the difference between revenue and profit is critical for evaluating your business’s financial health. Surprisingly, nearly 42% of small business owners admit they had little to no financial knowledge when they started their ventures.

How to Tell If Your Business Is Making Money

Beyond crunching numbers, there are practical ways to gauge profitability. Signs of a healthy, profitable business include a steadily growing bank balance, consistently paying bills on time, and having extra funds for reinvestment or reducing debt. On the flip side, struggling to make payroll or watching your account balances shrink are warning signs that your expenses might be outpacing your revenue. Regular financial tracking can help you spot these patterns early, giving you the chance to make adjustments.

Up next, we’ll dive into why manual financial tracking may be holding you back from achieving the clarity and efficiency your business needs.

Why Manual Financial Tracking Is Difficult

Keeping track of finances manually - whether through paper, spreadsheets, or a pile of receipts - can be a time-consuming and frustrating process. Small business owners who rely on these outdated methods could spend up to 553 hours annually (that's nearly 70 full workdays) just managing their finances. Switching to automated financial software could save all that time. The struggle becomes even more apparent when every single transaction has to be processed by hand.

When Math Becomes a Roadblock

If numbers aren't your thing, manual financial tracking can feel like a never-ending uphill climb. Every transaction needs to be entered manually, and accounts have to be reconciled one by one. As Wave aptly puts it:

"With everything in one place, there's no need to endlessly research solutions or stare at spreadsheets until your eyes glaze over".

The constant mental effort required to handle ever-changing financial data can leave you feeling drained and disconnected from the bigger picture. For many business owners - 42% of whom started their ventures with little to no financial knowledge - this adds an extra layer of stress they weren't prepared for.

The Pitfalls of Manual Tracking

Manual tracking isn't just tedious; it opens the door to errors and risks that can wreak havoc on your financial health. Mistakes like missed transactions, duplicate entries, or incorrect amounts can distort your financial records. And when tax season rolls around, disorganized records can turn into a nightmare. The IRS requires businesses to keep financial records for at least three years, and scrambling to locate missing receipts during an audit is a headache no one wants to face.

Beyond the risk of errors, manual tracking often means delayed updates. If you only update your books once a month, your financial data is already outdated by the time you review it. This delay can lead to missed opportunities, like unbilled revenue - forgetting to invoice clients for time or expenses you've already tracked - which is essentially leaving money on the table. Without up-to-date insights, it's nearly impossible to spot profit leaks or identify spending trends before they spiral out of control.

The impact of these issues goes far beyond inconvenience. Inaccurate records can result in missed tax deductions or even penalties from the IRS. You might find yourself in a cash crunch, unable to cover bills, simply because you didn't have a clear view of your finances. As your business grows and the number of transactions increases, what once felt manageable can quickly snowball into a major obstacle, hindering your ability to scale effectively.

How Software Makes Financial Management Easier

Financial software takes the hassle out of managing your finances by automating tasks that were once time-consuming and error-prone. Instead of juggling spreadsheets and calculators, these tools handle everything from tracking transactions to categorizing expenses, giving you a clear view of where your business stands. The shift from manual work to automation is a game-changer.

What Automation Does for You

Modern financial tools link directly to your bank and credit card accounts, pulling in transactions as they happen. This eliminates the need for manual data entry, keeping your records up-to-date without lifting a finger. Snap a photo of a receipt, and the app will read the total, identify the vendor, and file it under the right category - saving you hours of work.

AI-driven features take this a step further. For example, platforms like QuickBooks use intelligent systems to learn your habits, automatically matching transactions to categories based on your past actions. If you frequently buy supplies from a particular vendor, the software remembers and categorizes future purchases accordingly. It can even cross-check your bank statements with your internal records, flagging discrepancies and suggesting corrections before they become bigger issues.

Automated invoicing is another time-saver. The software generates professional invoices, calculates sales tax, and sends payment reminders to clients. These reminders can speed up payments by 45%, often getting you paid an average of five days faster. Instead of deciphering complex spreadsheets, you can rely on visual dashboards that present your revenue, expenses, and profits in easy-to-read charts. This streamlined approach can save small business owners up to $7,000 in billable hours annually. With such features, financial software not only simplifies your workflow but also provides a clear snapshot of your business performance.

How to Pick the Right Software

With these automation benefits in mind, choose software that’s intuitive and avoids overwhelming you with technical jargon. Look for platforms designed for small business owners or freelancers rather than professional accountants. These tools often use straightforward language, making them accessible even if you don’t have a financial background.

Tatiyanna W. from TruCreates.com shares her experience:

"Wave makes your life a whole lot easier and takes that worry off you. I've tried QuickBooks - it's a bit more complicated and technical, and takes more time to set up."

It’s also worth checking whether the software provides live expert support or bookkeeping guidance, especially if you’re new to financial tools or preparing for tax season. A strong mobile app is crucial too - you’ll want the ability to capture receipts and keep an eye on cash flow no matter where you are. Before committing to a subscription, take advantage of free trials or starter plans to see if the software’s automation features genuinely simplify your workflow.

sbb-itb-3dd36ef

Financial Tracking Software Options for Small Businesses

Once you decide to automate your finances, the next step is finding the right software to meet your needs. A good tool should handle tedious calculations, sync seamlessly with your bank accounts, and present your financial data in an easy-to-digest format. Building on how automation can simplify financial management, here are three platforms designed to streamline revenue and expense tracking for small business owners.

Directoury: Tailored Technology for Experience-Based Businesses

For those running tour, activity, or experience-based businesses, Directoury is a platform that simplifies finding the right tools for your operations. It connects business owners with over 200 verified software vendors specializing in booking systems, payment processing, and financial tracking tools tailored to the travel and tourism industry. Directoury’s personalized matching system identifies solutions that align with your specific needs - whether it’s managing reservations, processing payments, or tracking expenses across multiple locations. This saves you hours of research. To make decision-making easier, the platform also provides detailed buyer guides and verified reviews, cutting through technical jargon and helping you evaluate options with confidence.

Expensify: Simplifying Receipt and Expense Management

If receipt clutter and manual data entry are your pain points, Expensify might be the solution. Its SmartScan feature uses AI to extract key details like merchant names, dates, and amounts from receipt photos, automatically categorizing expenses into tax-friendly groups such as Advertising, Meals, and Travel. Users have reported saving over 48 hours a month by using SmartScan instead of manually logging receipts. Expensify also includes a Concierge AI that flags duplicate receipts and policy violations, helping to catch errors early. The platform integrates with popular accounting software like QuickBooks and Xero, ensuring your expense data syncs automatically. For individuals, Expensify is free, while company plans start at $5.00 per member per month. As Weston M., an Expensify user, puts it:

"Expensify makes the process easier by prompting you to auto-import expenses as you go, and its intuitive interface simplifies expense tracking."

QuickBooks: Real-Time Financial Insights

QuickBooks stands out with its real-time profit and loss dashboards and bank syncing features. The software connects directly to your bank and credit card accounts, importing transactions daily and categorizing them automatically based on past activity. This keeps your books up-to-date without requiring constant manual input. QuickBooks also generates instant financial statements like Profit and Loss reports, Balance Sheets, and Cash Flow analyses, providing a clear picture of your financial health at any moment. Additionally, it automates recurring invoices and sends payment reminders, helping you get paid faster. While QuickBooks offers more advanced features than some competitors, setting it up initially may take a bit more time.

How to Set Up Financial Tracking Software

You don’t need to be an accountant to get started with financial tracking software. Most platforms are designed to be user-friendly, guiding you step-by-step through the setup process. From picking the right tool for your needs to gaining actionable profit insights, here’s how to get up and running.

Step 1: Choose Your Software

Start by figuring out what your business needs most. If you’re a freelancer or solopreneur looking for simple income and expense tracking, opt for software that’s easy to use, even for non-accountants. For instance, Wave, rated 4.6/5, is a great option for freelancers and small businesses focused on straightforward money management. If managing receipts is your biggest challenge, look for tools with mobile scanning features. For businesses planning to grow, pick a platform that offers a free plan for basic needs and paid tiers for advanced capabilities.

Before making a decision, ensure the software includes critical features like bank syncing (to eliminate manual data entry), automated reporting (for quick Profit and Loss statements), and cloud access (so you can check your finances on any device). You’ll also need to decide on your accounting method. Cash accounting records transactions when money changes hands, while accrual accounting tracks income when an invoice is sent, regardless of payment timing. For freelancers and small businesses, cash accounting is often the simpler choice.

Step 2: Connect Your Bank Accounts

Set up a separate business bank account before linking anything - it’s essential to keep personal and business finances separate to avoid confusion and tax headaches. Once your business account is ready, use your software’s secure connection tool (many platforms rely on services like Plaid) to link your bank accounts and credit cards. This allows transactions to sync automatically, cutting down on manual entry and reducing errors.

After connecting your accounts, organize your transactions into categories that align with IRS tax deductions, like Advertising, Office Supplies, Meals, and Travel. Most software will auto-categorize transactions based on merchant details, but it’s a good idea to regularly review these categories - weekly or monthly - to catch any mistakes. Use the mobile app to scan paper receipts as soon as you get them. This creates a digital backup, making tax season much smoother. With your transactions syncing seamlessly, you’re ready to dive into your first profit report.

Step 3: Create Your First Profit Report

Head to the “Reports” section of your software and select the “Profit and Loss” or “Income Statement” option. Set a specific date range, like the past 30 days or the current quarter, to assess your financial performance. The software will calculate your Net Profit by subtracting total expenses from total income. If the result is positive, you’re in the black; if it’s negative, your expenses are outpacing your revenue.

Review this report every month to identify trends. Are certain expenses growing faster than your income? Do you notice seasonal dips in revenue? These insights can guide decisions about pricing, spending, and managing cash flow. Once you’re comfortable generating these reports, you might want to invite a bookkeeper or accountant to review your data. Most platforms allow you to grant them “read-only” access, giving you expert oversight without compromising control.

Feature Comparison: Financial Tracking Tools

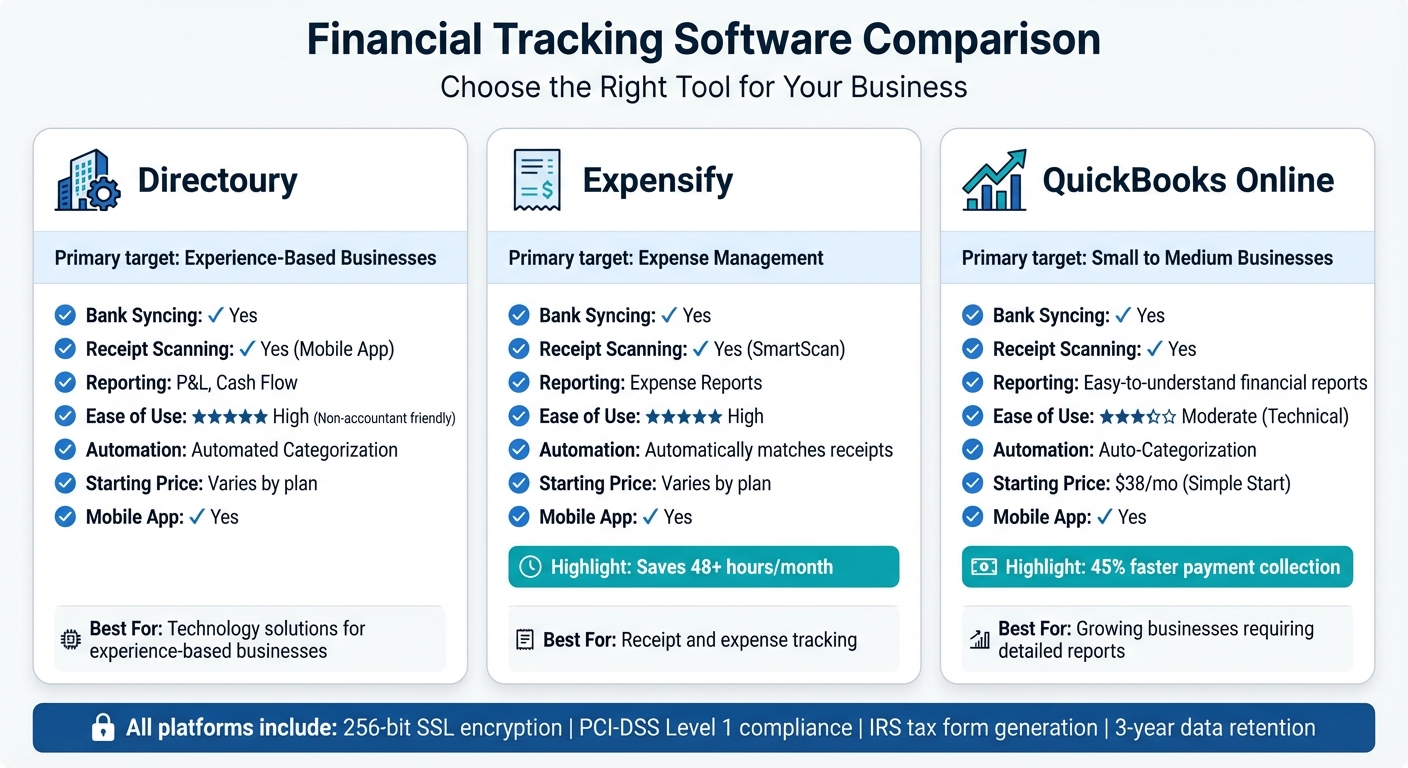

Financial Tracking Software Comparison: Features and Pricing Guide

Software Feature Comparison Table

Choosing the right financial tracking tool depends on your business needs. For solopreneurs, simplicity and affordability might be top priorities. On the other hand, growing teams often look for advanced automation and detailed reporting capabilities.

Here’s a side-by-side comparison of Directoury, Expensify, and QuickBooks Online based on essential features like pricing, automation, mobile access, and usability. This breakdown can help you pinpoint the tool that aligns with your goals.

| Feature | Directoury | Expensify | QuickBooks Online |

|---|---|---|---|

| Primary Target | Experience-Based Businesses | Expense Management | Small to Medium Businesses |

| Bank Syncing | Yes | Yes | Yes |

| Receipt Scanning | Yes (Mobile App) | Yes (SmartScan) | Yes |

| Reporting | P&L, Cash Flow | Expense Reports | Easy-to-understand financial reports |

| Ease of Use | High (Non-accountant friendly) | High | Moderate (Technical) |

| Automation | Automated Categorization | Automatically matches receipts | Auto-Categorization |

| Starting Price | Varies by plan | Varies by plan | $38/mo (Simple Start) |

| Mobile App | Yes | Yes | Yes |

| Best For | Technology solutions for experience-based businesses | Receipt and expense tracking | Growing businesses requiring detailed reports |

QuickBooks Online stands out with its detailed reporting features, ranging from standard financial reports to custom KPI dashboards available in its Advanced tier, priced at $275/month. It also includes automated invoice reminders, which have been shown to accelerate payment collection by 45% on average.

Security and compliance are equally important considerations. All three platforms utilize 256-bit SSL encryption and meet PCI-DSS Level 1 standards. They also ensure accurate IRS and state tax form generation while securely backing up data for the required three-year retention period.

Conclusion

You don’t need an accounting degree to figure out if your business is making money. Automating your bookkeeping takes the headache out of manual tasks and gives you instant insight into your finances. With the right financial tracking software, you can sync your bank accounts, categorize transactions, and generate detailed reports that lay out your revenue, expenses, and profit in plain terms.

That means less time wrestling with spreadsheets and more time focusing on growing your business. Directoury’s financial tracking solution turns what used to be a stressful and error-prone process into something simple and easy to manage.

The steps we’ve outlined above make it possible to ditch the spreadsheets and focus on what truly matters - building your business. All it takes is choosing software that feels right for you, linking your bank accounts, scanning receipts with a mobile app, and checking your dashboard regularly to stay on top of your money flow. The clarity and peace of mind that come with understanding your financial health are well worth the investment, giving you the tools you need to succeed.

FAQs

What are the advantages of using financial tracking software instead of tracking finances manually?

Using financial tracking software simplifies the way you manage your finances. These tools automatically pull in transactions, sort your income and expenses into categories, and create up-to-date reports. This means no more tedious manual data entry, and it significantly lowers the chances of errors. Plus, with user-friendly dashboards, you can quickly get a clear picture of your financial health - no advanced math required.

Since your data is securely stored in the cloud, you can access it from any device. This makes it easy to collaborate with your accountant and breeze through tax season with ready-to-go reports. It’s a time-saver that helps you stay organized, ensures compliance, and lets you focus on running and growing your business instead of being buried in spreadsheets or paperwork.

Financial tracking software takes the stress out of bookkeeping, giving you peace of mind and more time to focus on what truly matters.

How can I find simple financial software to track my business revenue and expenses?

Choosing financial software comes down to finding a tool that meets your specific needs while making bookkeeping less of a hassle. Start by figuring out what’s most important for you. Is it ease of use, especially if numbers aren’t your strong suit? Maybe it’s the cost, whether you prefer free options or don’t mind paying for extra features. Or perhaps automation is key - like automatically importing bank transactions or generating reports. A good platform should also offer clear, visual summaries of your revenue and expenses, helping you quickly understand where your business stands financially.

Once you’ve nailed down your priorities, take advantage of free trials or basic plans to test a few options. Pay attention to how easy the setup process feels, whether the mobile app runs smoothly, and if the software integrates well with your bank or other tools you already rely on. It’s also smart to think ahead - pick a platform that can grow with your business, offering features like payroll or multi-user access when you need them, without forcing a big upgrade. The right software will simplify tracking your finances and give you the confidence to manage your business’s bottom line effectively.

What can I do if my expenses are higher than my revenue?

If your spending regularly outpaces your income, it’s time to take control of your finances. Start by using straightforward financial tracking software. These tools can automatically sort your income and expenses, pinpoint areas where you're overspending, and generate clear, easy-to-understand reports.

Once you've identified where the trouble lies, work on cutting unnecessary expenses and exploring ways to bring in more revenue. This might mean fixing overlooked billing issues or tweaking your pricing strategy. Choose solutions that are simple to implement and help you manage your finances without needing a background in advanced math.

Related Blog Posts

- HR Software for Small Tour Operators: Top Options

- How to Track Tour KPIs Effectively

- What's the difference between all these booking systems I keep hearing about? Do I actually need one or can I just use Google Calendar and email?

- Can I run tours without a business bank account, or do I need to separate my personal and business money from day one?