Short Answer: While Venmo might seem convenient for accepting payments, it’s not designed for business use. It lacks essential features like fraud protection, detailed tax reporting, and professional invoicing. Instead, you should use business-focused payment platforms like Stripe, Square, or PayPal Business. These platforms offer secure transactions, compliance tools, and customer support, ensuring a safer and more professional experience for both you and your customers.

Key Takeaways:

- Venmo and similar apps are better suited for personal transactions. Using them for business can lead to account freezes, disputes with no seller protection, and tax reporting challenges.

- Business payment platforms provide critical features such as fraud detection, PCI compliance, and integration with accounting tools.

- Processing fees for platforms like Stripe, Square, and PayPal Business typically range from 2.9% + $0.30 per transaction.

Quick Comparison of Payment Platforms:

| Platform | Online Fee | In-Person Fee | Key Features | Best For |

|---|---|---|---|---|

| Stripe | 2.9% + $0.30 | N/A | Fraud detection, custom integrations | High transaction volumes |

| Square | 2.9% + $0.30 | 2.6% + $0.10 | Mobile-friendly, in-person and online payments | Simplicity and in-person sales |

| PayPal | 2.9% + $0.30 | N/A | Trusted brand, email privacy | Customer trust and privacy |

Why This Matters: Using a professional payment platform not only protects your business but also builds trust with customers, ensuring smoother operations and better long-term growth.

How to Choose the Best Payment Processor: Stripe, PayPal, or Merchant Account?

Consumer Payment Apps vs. Business Payment Platforms

Consumer payment apps and business platforms serve different purposes and come with distinct features. Apps like Venmo, Zelle, and Cash App are great for casual transactions, like splitting a dinner bill or paying a friend back. However, they’re not designed to handle the complexities of business transactions, which often require detailed documentation, dispute management, and regulatory compliance. Let’s break down the key differences, starting with the challenges of using consumer apps for business.

Problems with Consumer Payment Apps

Using consumer apps for business can lead to several issues:

- Account freezes can disrupt your cash flow. These apps rely on automated systems to flag unusual activity, and frequent payments from multiple customers can trigger alerts. If your account gets frozen, you might lose access to your funds for days - or even weeks - while an investigation takes place.

- There’s no seller protection. If a customer disputes a charge, you’re left with little to no recourse. These apps don’t provide formal processes for submitting evidence, like proof of service or contracts, leaving you vulnerable to chargebacks and revenue loss.

- Tax reporting is complicated. These apps offer minimal tools for tracking business income. While you’ll receive a 1099-K form if you process over $600 annually, it’s up to you to manually track transactions, increasing the risk of errors.

- Professional invoicing isn’t an option. Consumer apps don’t allow you to send detailed invoices, apply discounts, or set up recurring payments. This forces businesses to juggle multiple systems for billing and payments, creating unnecessary confusion for both you and your customers.

While consumer apps may suffice for personal use, they fall short in meeting the demands of a professional business environment. That’s where dedicated business payment platforms come in.

Benefits of Business Payment Platforms

Business platforms like Stripe, Square, and PayPal Business are purpose-built for handling professional transactions and come with features designed to solve the challenges outlined above:

- Advanced fraud protection. These platforms use tools like machine learning, pattern analysis, and customer verification to detect and prevent suspicious activity, offering a layer of security consumer apps simply don’t have.

- Built-in PCI compliance. Business platforms automatically adhere to strict credit card security standards, so you don’t have to worry about implementing these measures yourself. This ensures customer payment data stays secure while reducing your liability.

- Seamless integration with other tools. Business platforms can connect directly to your booking systems, CRM software, and accounting tools. This streamlines your operations by eliminating the need for manual data entry and providing real-time insights into your finances.

- Structured dispute resolution. When customers raise concerns, business platforms give you a framework to address issues effectively. You can submit service contracts, proof of delivery, and other documentation to support your case, often resolving disputes before chargebacks occur.

Comparison Table: Consumer Apps vs. Business Payment Platforms

| Feature | Consumer Payment Apps | Business Payment Platforms |

|---|---|---|

| Fees | Free for bank transfers, 3% for cards | 2.9% - 3.5% per transaction |

| Seller Protection | Limited or none | Comprehensive fraud protection |

| Tax Reporting | Basic 1099-K only | Detailed transaction reports |

| Professional Invoicing | Not available | Full invoicing capabilities |

| Dispute Resolution | Minimal, buyer-favored | Structured evidence submission |

| Account Stability | High freeze risk for business use | Designed for high transaction volumes |

| Customer Support | Limited, automated responses | Dedicated business support teams |

| Recurring Payments | Not supported | Built-in subscription management |

| Multi-currency Support | USD only | International payment processing |

This table highlights why business platforms are the smarter choice for professional transactions. While consumer apps may seem like a cost-effective option, the potential risks - like losing access to funds or facing disputes without support - can harm your business in the long run. Business payment platforms not only protect your transactions but also enhance your ability to operate efficiently and professionally. They provide the tools and security you need to build trust with your customers and grow your business.

How to Choose a Secure Payment Solution

When selecting a payment platform, focus on minimizing security risks, ensuring compliance, and simplifying operations. Start by assessing the platform's security features.

Security and Fraud Prevention

The first thing to check is PCI DSS compliance. The Payment Card Industry Data Security Standard (PCI DSS) establishes guidelines for securely handling credit card information. If your business processes credit card payments, compliance with these standards isn’t optional - it’s a legal requirement.

Look for platforms that include advanced fraud detection systems. These systems often use machine learning to analyze transaction patterns in real time. Features like address verification, CVV checks, and velocity filters help identify and block fraudulent transactions automatically. Some platforms even allow you to create custom risk rules tailored to your business model and customer behavior.

Another critical feature is data encryption. Your payment processor should encrypt sensitive information during transmission and while it’s stored. End-to-end encryption ensures customer payment data stays protected throughout the entire transaction.

Regulatory Compliance

In the United States, payment compliance involves several regulatory bodies that work together to safeguard consumers and maintain financial system integrity. For example, the Federal Reserve System sets policies to ensure transaction safety, while the Consumer Financial Protection Bureau (CFPB) monitors businesses to ensure they offer fair and transparent payment services. Additionally, the Federal Trade Commission (FTC) enforces laws to protect consumers from deceptive practices.

Your payment platform should also handle Know Your Customer (KYC) and Know Your Business (KYB) requirements effectively. These processes verify the identities of customers and business partners, helping to prevent fraud, money laundering, and other financial crimes. A good payment processor automates these procedures, reducing your administrative workload while ensuring compliance.

Integration with Business Tools

A payment platform should integrate seamlessly with the tools you already use. This includes your website, point-of-sale systems, inventory management software, booking tools, accounting software, and CRM platforms. Before committing to a processor, make a list of your current tools and confirm that the platform supports integration with each one.

Strong APIs and detailed documentation are essential for smooth integration. These features ensure a seamless flow of data between your payment system and other tools like your website, accounting software, or CRM. Responsive customer support is also key for resolving any integration challenges. Keep in mind that some setups may require data to be transformed into different formats, which can complicate the process. For instance, ScienceSoft highlighted in 2025 how integrating an online payment gateway with an accounting system can automate recurring payments and instantly record transactions, reducing manual errors.

Don’t overlook scalability. Your payment platform should be able to handle increased transaction volumes and adapt to new technologies as your business grows. Also, consider how the integration impacts your customers’ experience. Avoid platforms that add unnecessary steps, such as excessive form fields or multiple redirects, as these can lead to cart abandonment.

Finally, think about how these integrations contribute to overall efficiency. Developing a payment strategy aligned with your business model, sales channels, and preferred payment methods ensures the platform meets your needs today and evolves with your business.

sbb-itb-3dd36ef

Best Payment Platforms for US Experience Operators

For experience businesses in the US, three reliable and secure payment platforms stand out: Stripe, Square, and PayPal.

Overview of Stripe, Square, and PayPal

Stripe is known for its advanced fraud detection powered by machine learning, which analyzes transaction patterns in real time to handle high volumes of transactions efficiently. It’s designed with developers in mind, offering a flexible system that integrates seamlessly with booking or management tools.

PayPal prioritizes security with end-to-end encryption, 24/7 transaction monitoring, and fraud detection systems. One of its standout features is email privacy - only your email address is shared with customers, keeping your financial details private. For added protection, you can link a credit card instead of directly connecting your bank account.

Square shines with its intuitive mobile app, which supports both in-person and online transactions. While it adheres to standard security protocols, its true strength lies in its simplicity, making it a great choice for business owners who want an easy-to-use payment solution.

All three platforms are PCI DSS compliant, ensuring secure handling of credit card information.

Comparison Table: Features and Fees of Leading Platforms

Here’s a quick look at the fees, security features, and strengths of each platform:

| Platform | Online Transaction Fee | In-Person Transaction Fee | Setup Fee | Monthly Fee | Key Security Features | Best For |

|---|---|---|---|---|---|---|

| Stripe | 2.9% + $0.30 | N/A (primarily online) | $0.00 | $0.00 | Machine learning fraud detection, PCI DSS compliance, high-volume scalability | Custom integrations, high transaction volumes |

| PayPal | 2.9% + $0.30 | N/A (primarily online) | $0.00 | $0.00 | End-to-end encryption, 24/7 monitoring, email privacy protection | Brand recognition, customer trust |

| Square | 2.9% + $0.30 | 2.6% + $0.10 | $0.00 | $0.00 | Industry-standard encryption, mobile-friendly interface | In-person & online sales, simplicity |

While all three platforms charge the same fees for online transactions - 2.9% + $0.30 per successful transaction - Square offers a slight edge for in-person transactions at 2.6% + $0.10. This can lead to savings for businesses that frequently process payments during events, tours, or at physical locations.

Other costs to keep in mind include Square’s $0.50 fee per delivery order, Stripe’s ACH direct debit option at 0.8% with a $5.00 cap, and potential international conversion fees with PayPal. Stripe also supports Buy Now Pay Later services like Klarna, with fees starting at 5.99% + $0.30 per transaction.

Each platform has its strengths. Stripe is ideal for businesses needing advanced fraud detection and custom integrations. PayPal is a trusted choice for those prioritizing customer trust and privacy. Meanwhile, Square stands out for its versatility in handling both online and in-person payments with ease.

Evaluate your specific business needs and choose the platform that aligns best with your operations and customer expectations. These options provide a solid foundation for creating a payment system tailored to your business.

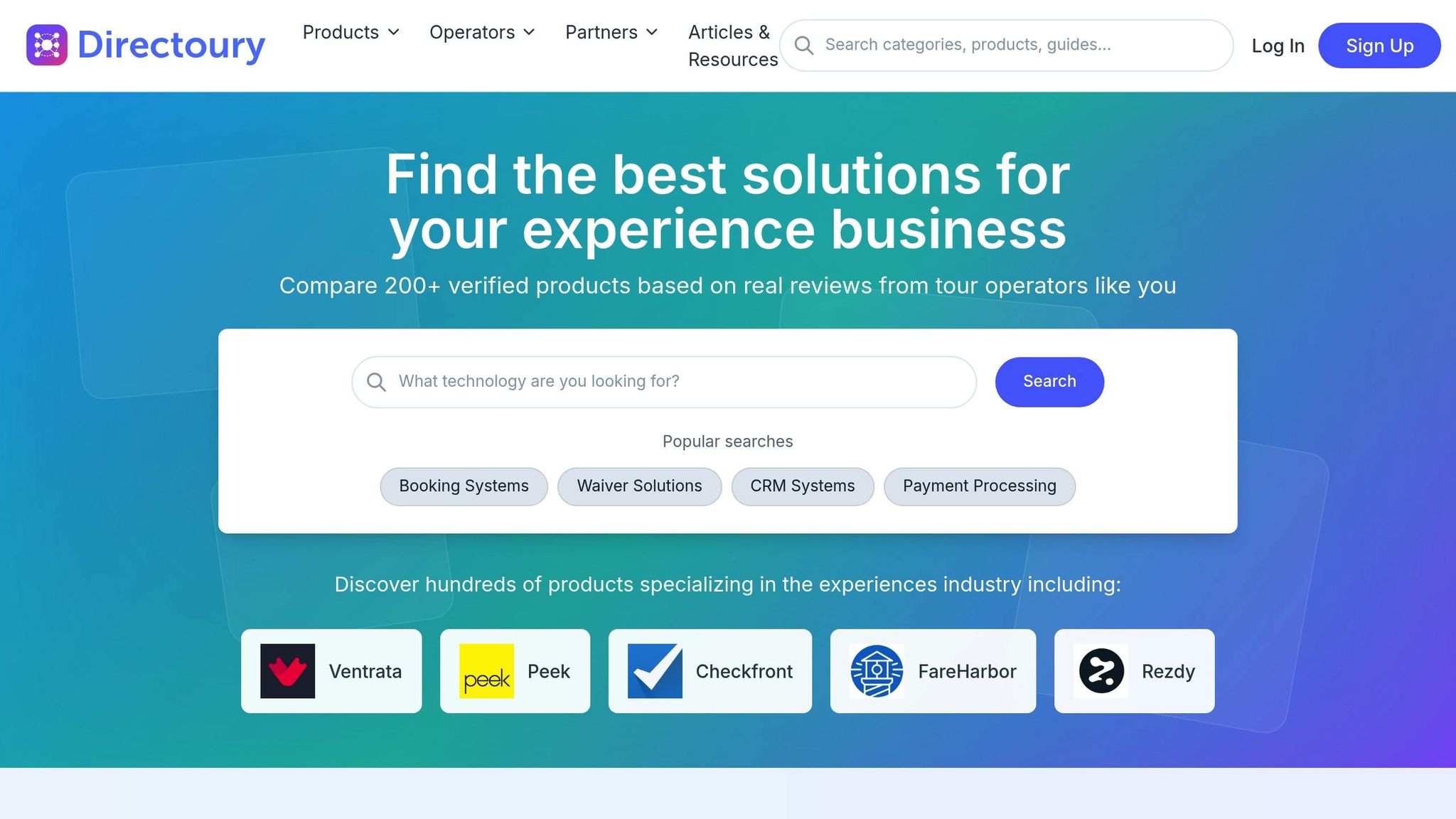

Using Directoury for Expert Guidance

When it comes to finding secure and reliable payment solutions, having the right guidance can make all the difference. That’s where Directoury steps in. Designed specifically for tour operators, activity providers, and experience-based businesses, Directoury helps you navigate the often-complicated world of technology and payment processing systems.

Directoury connects you with carefully vetted vendors and provides expert advice tailored to your business needs. With tools like AI-powered vendor recommendations, detailed buyer's guides, and verified reviews, it simplifies complex payment concepts into actionable steps you can take with confidence.

One of Directoury’s standout features is its personalized tech-match system. This tool aligns technology solutions with your specific requirements and provides expert assistance to tackle challenges such as compliance, security, and integration. Whether you’re setting up a secure payment system, ensuring compliance, or integrating new tools, Directoury offers the support you need to create a smooth and secure operation.

Founded by Alex Kremer and Jason Hackett, Directoury focuses exclusively on the experience economy. This means the guidance and recommendations you receive are tailored specifically for businesses like yours - no generic advice, just solutions built for the unique demands of experience-driven industries.

Conclusion: Choosing the Right Payment Solution for Your Business

Picking the right payment solution for your business goes beyond just processing transactions - it's about ensuring trust, staying compliant, and safeguarding your revenue. While consumer-focused apps like Venmo might seem convenient, they aren't built to handle the complexities of running a professional business in the United States.

Business-grade payment platforms are designed with these challenges in mind. They provide advanced security features, compliance tools, and professional-grade functionality that help simplify your operations. These platforms often include essentials like PCI DSS compliance, fraud detection, automated tax reporting, and seamless integration with your existing systems, giving you a solid framework to grow your business.

When evaluating payment solutions, focus on factors such as security protocols, regulatory compliance, ease of integration, and the overall cost of ownership. Popular platforms like Stripe, Square, and PayPal each bring unique advantages, but your choice should align with your specific needs - whether it's transaction volume, technical requirements, or your business model.

FAQs

Is it safe to use apps like Venmo for business payments, or should I use a dedicated payment platform?

Using consumer payment apps like Venmo for business transactions comes with potential risks. These apps are built mainly for personal use, which means they often fall short when it comes to the security, compliance, and features required for professional transactions. For instance, they might lack robust fraud protection or fail to meet legal standards for processing customer payments.

For a safer and more professional approach, opt for a dedicated payment platform designed specifically for businesses. These platforms typically offer stronger security measures, reliable customer support, and tools to streamline transaction management while ensuring compliance with industry regulations.

What are the benefits of using business payment platforms to ensure secure and compliant transactions?

Business payment platforms are built to prioritize security and compliance, ensuring your transactions remain protected. They rely on advanced tools like encryption, tokenization, and fraud detection to safeguard sensitive customer information. Plus, these platforms adhere to industry standards like PCI DSS, so your business stays aligned with essential security requirements.

Many of these platforms also include features such as address verification and multi-factor authentication, which help minimize the chances of fraudulent activity. By implementing a reliable payment solution, you’re not just protecting your business - you’re also creating a secure and smooth payment process that strengthens customer trust.

What should I look for when selecting a secure payment platform for my business?

When selecting a payment platform, start by thinking about your business needs and how your customers prefer to pay. Do they lean toward credit cards, digital wallets, or bank transfers? Picking a platform that supports these payment methods can make transactions smoother and improve customer satisfaction.

Security is another key factor. Check if the platform offers encryption, fraud prevention tools, and complies with PCI standards to safeguard both your business and your customers. Don’t overlook the fee structure either - transaction fees and potential hidden costs can eat into your profits. Aim for a platform that fits your budget and can grow with your business.

Lastly, consider the impression the platform leaves on your customers. A reliable and professional system not only builds trust but can also encourage them to return for future purchases.